This Week at a Glance:

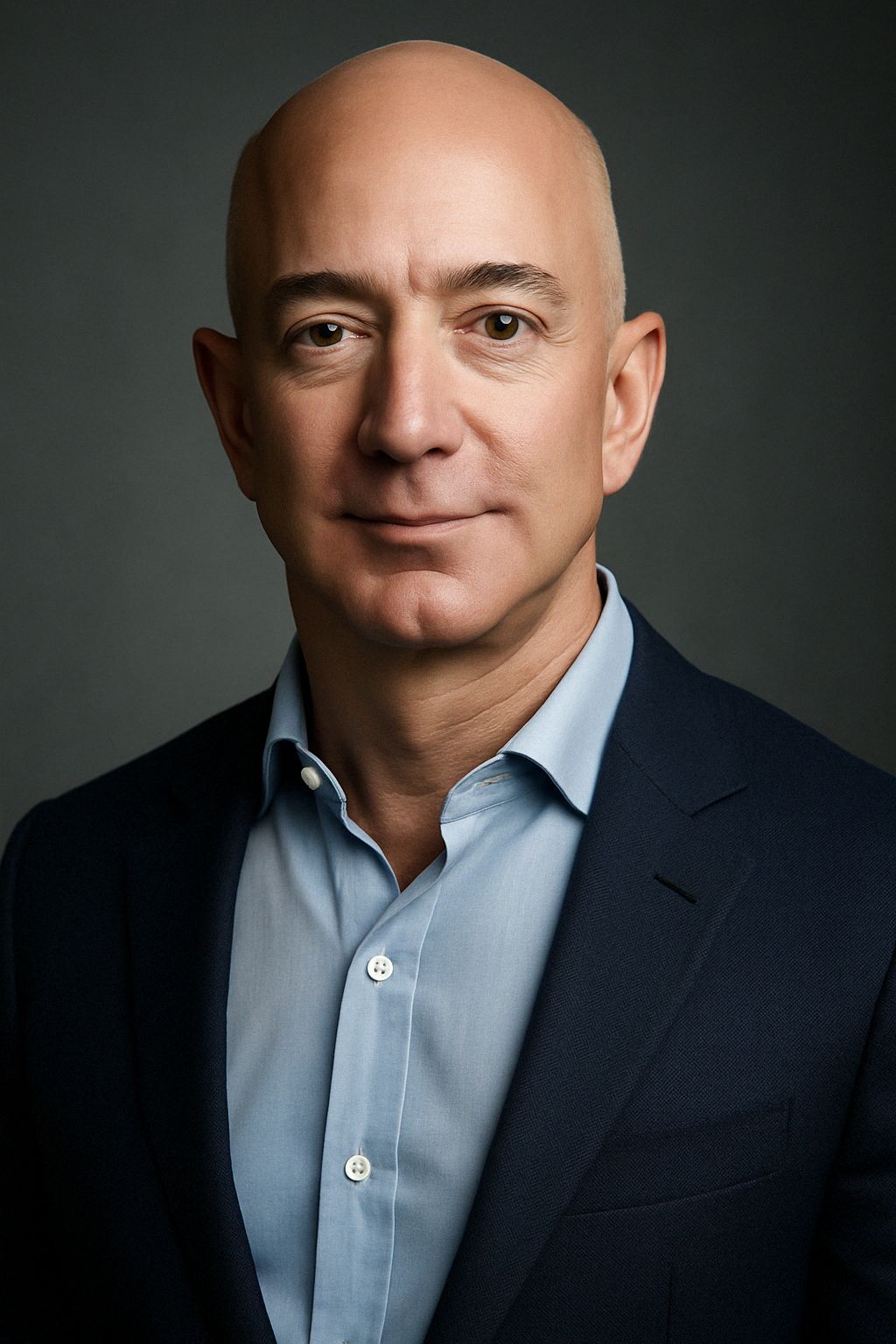

🧠 Mental Model: Bezos’ Regret Minimization Framework

📊 Strategy Breakdown: Diversification vs. Concentration – Which one builds real wealth?

💸 Investor Beware: The Hidden Costs of Investing

Regret Minimization

The mental model that helped Jeff Bezos build Amazon—and how it can help you live with conviction

Jeff Bezos had a great job at a hedge fund.

He was safe. Comfortable. Respected.

But one question changed everything:

When I’m 80, will I regret not doing this?

That question pushed him to quit—and launch Amazon.

Since then, that question became his personal decision filter for all of life’s major questions.

Because it’s not about chasing success—it’s about making sure you don’t wake up one day full of what-ifs.

Why it matters:

Most people don’t regret failing.

They regret not trying.

They regret staying small when they felt the pull to go bigger.

They regret ignoring their gut when it whispered, “This matters.”

📌 Try it yourself:

Ask: If I keep doing what I’m doing now…will I regret it when I’m 80?

If the answer is yes—it’s time to act.

Even if it’s scary. Even if it’s uncertain.

Because that’s where your real life begins.

Diversification vs Concentration

The uncomfortable truth about how wealth is actually built

We’re told to diversify.

To not put all our eggs in one basket.

That’s how you play it safe.

But here’s the uncomfortable truth:

Most great fortunes weren’t built through diversification.

They were built through concentration—on one skill, one company, one opportunity.

Bezos. Musk. Buffett.

They didn’t spread the risk.

They bet big on what they knew—and went all in.

Does that mean diversification is bad?

No. It’s how you protect wealth.

But concentration is how you build it.

If you’re early in your journey, you probably don’t need 100 baskets.

You might just need one—and the courage to carry it well.

The Hidden Cost of Investing

You’re probably paying more than you think—even with “passive” investing

It’s not how much you pour in—it’s how much you keep.

Not all investment costs are obvious.

Some are printed in fine print. Others are buried in the math.

Here are three hidden costs every investor should watch out for:

📉 Expense Ratios

Also known as management fees, this is the annual fee a fund charges to manage your money. Even a 1% fee can quietly erode your returns over time—especially when compounded over decades. Look for lower-cost alternatives if performance is similar.

💸 Turnover Rate & Taxes

High-turnover funds are constantly buying and selling, which can trigger short-term capital gains. If you hold those funds in a taxable brokerage account, that tax bill gets passed on to you. You’re paying for activity you didn’t ask for—and it adds up.

🔍 The Bid-Ask Spread

Brokerages don’t charge trade commissions anymore—but that doesn’t mean trading is free. Many platforms make money by padding the bid-ask spread—the tiny gap between what buyers are willing to pay and what sellers are asking. It may seem small, but over time, it’s another leak in your bucket.

Most investors obsess over returns.

But smart investors pay just as much attention to costs.

Because over time, fees and friction quietly compound against you.